How can I file the Delaware annual report?

The deadline for filing the annual franchise tax report and paying the previous year's franchise tax is March 1st.

For more help with tax and compliance matters, see How can my corporation get help complying with Delaware's requirements?.

You can file the annual franchise tax report on the Delaware Division of Corporations website. As part of filing the annual franchise tax report (commonly called the annual report), your company must also pay Delaware's annual franchise tax. Corporations may complete this obligation themselves online or get help from their accountant or registered agent.

File the Report and Pay Taxes Yourself

- 1

- Go to the annual report and tax instructions page on the Delaware Division of Corporations website.

- 2

- Click the Pay Taxes / File Annual Report link.

- 3

- Enter your corporation's entity number. If you don't know it, use Delaware's business entity search to look up the number with your corporation's name. Then click Continue.

- 4

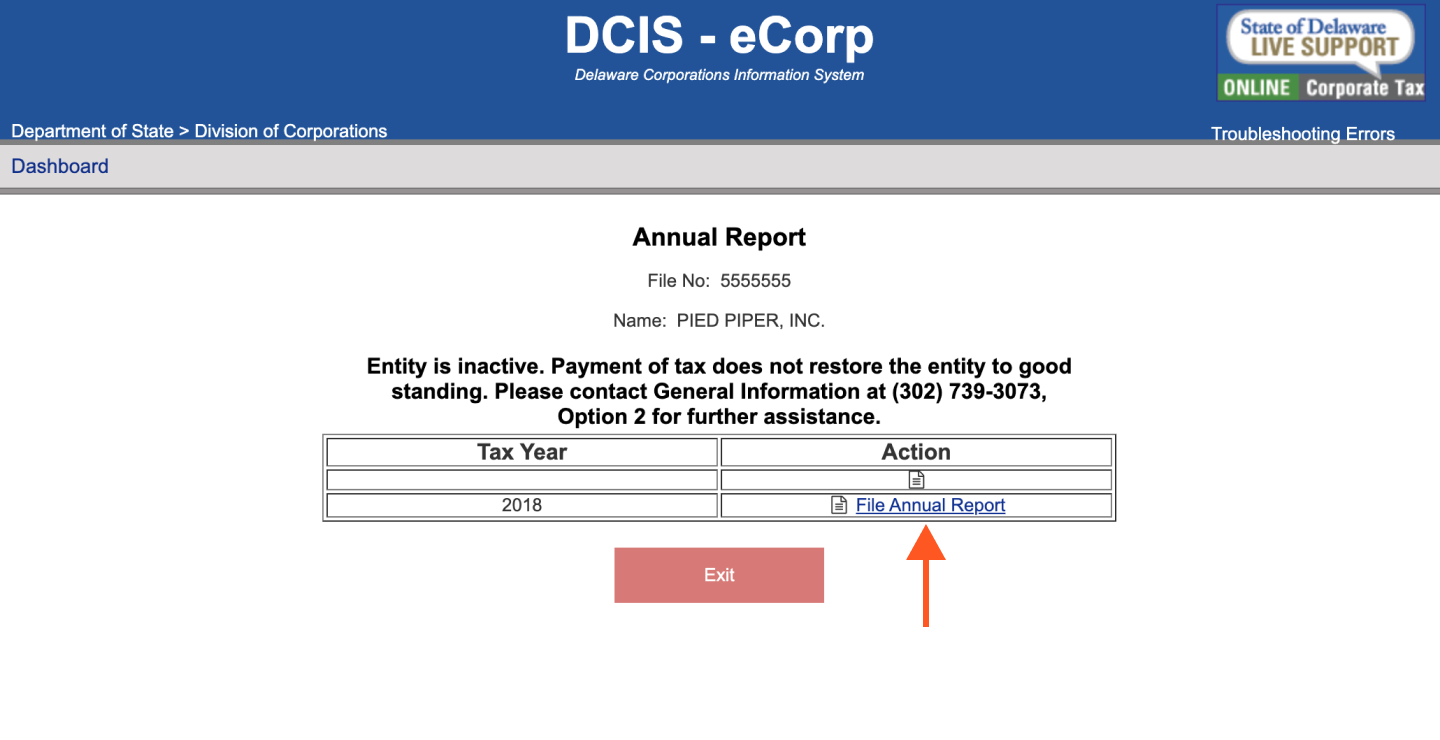

- Click on the File Annual Report link.

- 5

- Follow the prompts to pay taxes by credit card and complete the annual report. Many fields in the annual report include links to helpful explanations of the information required.

Get Help

If you need help filing the annual franchise tax report, see How can my corporation get help complying with Delaware's requirements? for resources.